At the outset, I would like to point out that this text is not investment advice. All information contained in it are my subjective thoughts on the cryptocurrency market.

This text is 100% free.

I have been thinking for a long time about gathering all my knowledge in one place. I wanted to create a compendium of knowledge about cryptocurrencies so that I could simply refer to this text when repeatedly asked the same questions by group members and friends.

In this text, I tried to provide an answer to each of the possible issues so that after reading it all (which will take you about 30-60 minutes) you will have complete knowledge that allows you to consciously invest in the cryptocurrency market.

You will learn the indicators that will make you feel incomparably more confident with your investments in this market.

Thus, you will understand that cryptocurrencies are not a gamble, but a forward-looking asset in which skillful investment gives higher returns than any other existing asset in the world.

Table of Contents

Why Does Bitcoin Have Any Value?

Lots of people don’t understand why Bitcoin is worth so much. Why would someone pay tens of thousands of dollars for some virtual numbers?

To understand this, we must realize that the value of the money we use on a daily basis is also contractual. In fact, it is fair to say that dollars, pounds or any other currency in the world are also worth nothing.

Why?

For something to be of value, it must exist in finite quantity and be difficult to obtain. For a very long time, gold was such a commodity serving for trade and meeting these requirements for a very long time.

Gold still meets these requirements but is hardly ever traded on a daily basis.

As gold itself is heavy and difficult to transport, at one point the idea was to keep it in a bank and in return receive confirmation of how much gold we deposited.

That confirmation was dollars. You could come to the bank at any time and exchange it back for gold deposited there. When someone wanted to make a purchase, they simply paid in cash and the person receiving it knew that they could exchange it back for gold at the bank at any time.

It was a very good system. There was as much cash as gold, while gold was (and still is) scarce.

We can’t find it on the street.

Unfortunately, in 1971, President Richard Nixon announced that he would henceforth suspend the dollar to gold.

What does this mean in practice?

From now on we cannot exchange dollars for gold, it means that banks simply do not have this gold. On the other hand, if there are dollars and there is no gold to cover them, that is, the dollars were plucked out of the air.

A small-scale example

- Suppose there is $1000 in circulation.

- The state has $500.

- Citizens have the remaining $500.

- There are only 100 products to buy, priced at $10 apiece.

At the moment when the dollars were covered in gold, the state could buy $500/$10 = 50 pieces of the product and the citizens would buy exactly the same.

Meanwhile…

If the money is not backed by gold, the state simply prints another $200 when it needs money.

What is the calculation now?

- We have $1,200 in circulation.

- The state has $700.

- Citizens still own $500.

- There are still 100 products available for purchase.

So the state can buy $700/$10 = 70 products.

In turn, citizens can buy $500/$10 = 50 products.

Something is already wrong because we only have 100 products, and if we wanted to use all the money we have in circulation, we could buy as many as 120 products.

Then there are two options:

- The state buys products with money plucked out of the air. There is a shortage of products on the market, so citizens are no longer able to get them. Thus, the $200 that citizens have is useless, because nothing can be bought with it.

- The product owner states that since there is so much interest, they will raise the price to $12.

Then the state can buy $700/$12 =~ 58 products.

In turn, citizens can buy $500/$12 =~ 42 products.

As you can see from the fact that the state printed $200 plucked out of the air, it is now able to buy 8 more products but citizens – 8 fewer products. This way, the state took your money without even touching your wallet.

Venezuela is an example of a country with inflation that has gone too far. There are practically no products in the stores, and if they are, they are so expensive that a month’s worth of work allows you to buy food that is enough for 2 days. Money has become so useless that people make baskets and wreaths out of it. They literally do it!

What does this have to do with Bitcoin?

Bitcoin is programmed so that its amount in circulation is limited in advance and amounts to 21 million coins.

What’s more, once every 4 years there is Halving, which means that every 4 years the reward for Bitcoin miners is twice smaller.

Thanks to these two factors, we get a good that is perfect like gold because it is more and more difficult to mine and its quantity is limited (the maximum you can mine is 21 million coins).

In addition, no one can ever take this good from us because we do not keep it at home but in a decentralized network supported by miners’ computers.

The only way to lose your Bitcoin is if the electricity is turned off all over the world.

However, then the whole system would collapse and thus you would not be able to choose your funds even from a standard bank.

What is a decentralized network?

The value of a decentralized network is that there is no one person who rules it. No one can suddenly come and order an additional 1 million Bitcoins to be added to the network.

Just like the governments of all countries in the world do.

Everything is already programmed, the code is freely available, and nobody can suddenly change it on their own.

In the case of centralized institutions such as banks, corporations or states, everything is supervised by a group of several people who can make you have $0 in your account with one click of the mouse.

Can you create a second Bitcoin?

Yes. Bitcoin code is freely available, and anyone can create their own Bitcoin.

The problem is that no one will use it.

Can you create a second Facebook?

Of course! If someone is an experienced programmer, they are able to reproduce the most important functionalities even during a working week. The question is who will use this platform? The hardest job to do is attract millions of users, not just programming the Facebook platform.

The same goes for all alternatives to Bitcoin. They can be created but no one will use them, and thus they will be completely worthless.

The same mechanism applies to metals. You can’t take a random piece of metal and say it’s worth as much as gold because it glows too. It is accepted around the world that gold has value and no other glowing alternative will be accepted.

What are Bitcoin Cycles all about?

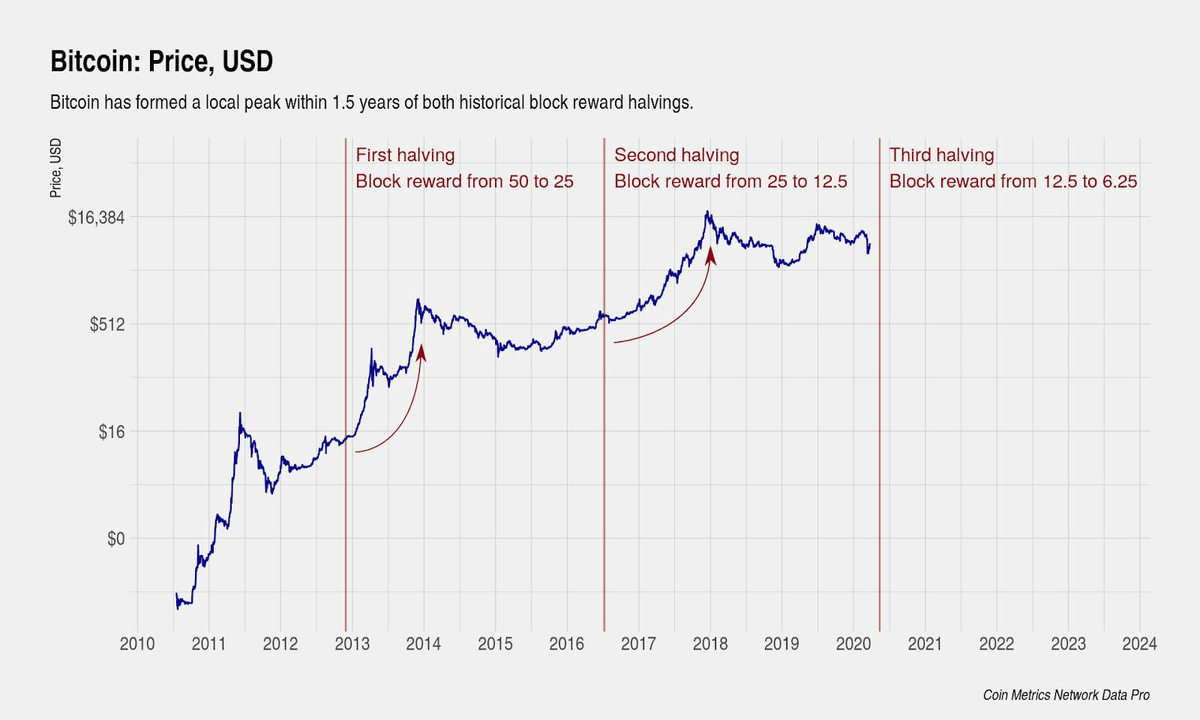

The Halving I mentioned earlier defines Bitcoin’s 4-year-cycles. You have probably heard more than once that the Bitcoin bubble has burst and it is heading to zero.

Namely, it breaks regularly every 4 years. It broke in 2013, in 2017 and will probably break at the turn of 2021 and 2022. Later, I will show you on chain indicators to help you identify when approximately this is likely to happen.

Cycles are characterized by the fact that a moment before Halving the price begins to rise slowly and immediately after Halving it accelerates significantly and this is the moment when we are in a full-fledged bull market.

The boom lasts about 1.5 years from Halving. The last Halving took place on May 18, 2020. Therefore, it is estimated that the current boom should close at the end of 2021.

The next Halving will be on March 16, 2024.

What happens at the end of the bull market?

That’s right… The bubble is bursting, and everyone is predicting the end of Bitcoin once again because they don’t know the cyclicality of this market and think something can grow forever. Well, no.

It is not possible for everyone to be in profit all the time. Every 4 years a reset occurs (the bubble bursts) and the cycle starts all over again.

Moreover, even in the classic stock markets, there are cycles that usually last 10 years but that is not the subject of this article.

It is worth noting that the end of the bull market is not a joke and Bitcoin then drops by an average of 83%!

However, the game is worth the effort because if you had bought 1 Bitcoin in 2013 when it cost $100, you would now have around $60,000 (as of May 4, 2021). Moreover, you wouldn’t have to do anything during this time. It was enough to just buy and keep it. You didn’t even have to sell it every 4 years at the end of the boom.

This probably clearly shows that Bitcoin, despite the fact that people regularly predict its end (not understanding its cyclicality), grows in the long term like no other assets.

Most people say that they would sell Bitcoin anyway with a minimal profit and would have to forget about it to actually earn so much. Today, fortunately, we have tools that show us with great accuracy when we can expect a bubble burst, so that we can sell our cryptocurrencies close to the top (because we will never hit the peak perfectly) and be able to buy them back after a standard fall of nearly 83%.

Curiosity. I know that 2013 is quite distant, so I will give you a closer example. If you had bought 1 Bitcoin in March 2020 when it cost $3,000, you would now (May 4, 2021) have $60,000. That is as much as 20 times more in just over a year. And this is not the end of the boom!

If you had invested $50,000 – you would have already had $1,000,000.

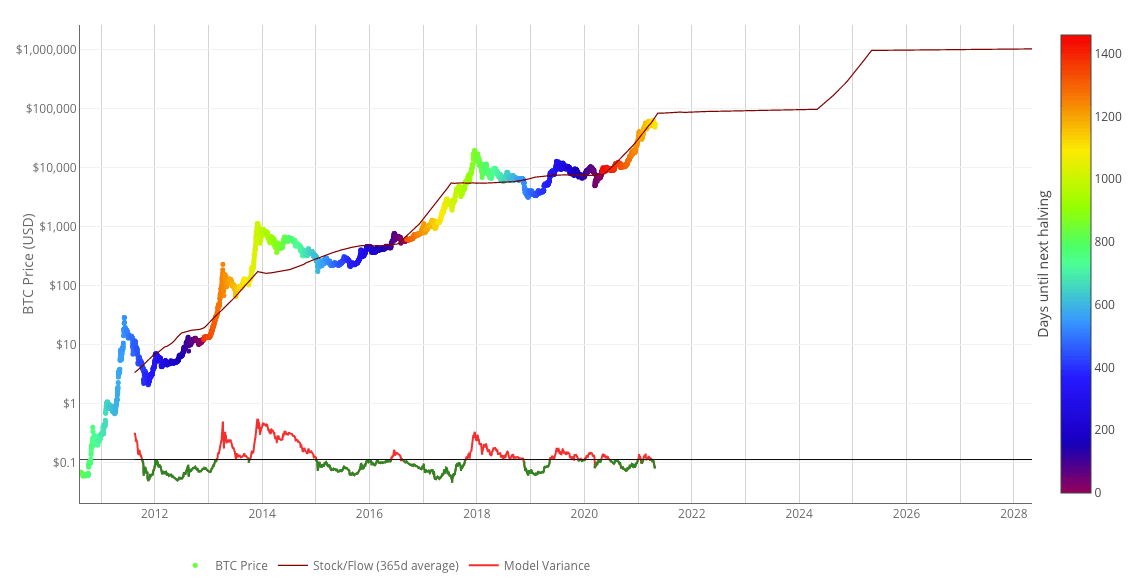

Stock to flow model

Taking into account the aforementioned Halvings, the Stock to flow model was created.

This chart can be found on the website: https://www.lookintobitcoin.com/charts/stock-to-flow-model.

This model shows what the fair price of Bitcoin is for the day. The closer to the next Halving, the more expensive Bitcoin should be because as you already know, after Halving it will be 2 times more difficult to mine.

When you hover over the chart, you will see the date and the price in dollars telling you how much Bitcoin should cost on a given day – also in the future. As you can see, the price of Bitcoin follows this model, so it is very reliable.

At the bottom you will find a smaller chart that shows whether the current real price is below the model’s price (green) or whether the price is above the model’s valuation (red).

In short, if the right part of the little chart is currently green, then Bitcoin is undervalued.

In turn, if it is red, it means that it is too expensive for this day and we may face a correction.

Remember that the price resulting from the model increases day by day, so today Bitcoin may be overvalued but if we wait a few days, its price may be adequate to the price resulting from the model.

How much can Bitcoin rise to during the 2021 boom?

Whenever people estimate how much Bitcoin will cost at the end of the boom, this one always surprises them.

During Halving on November 28, 2012, 1 BTC cost $10. Most people estimated the top would be $100. Meanwhile, at the end of 2013,

1 BTC already cost $1,237. This is an increase of almost 123 times in just over 1 year!

At the time of Halving on July 9, 2016 1 BTC cost around $520. On the other hand, at the peak of the boom in December 2017, it was already $19,345. This is an increase of over 37 times since Halving.

How is it now?

Many people predict that Bitcoin will cost $100,000 at the end of the boom in 2021. In my opinion, it will continue to surprise us and ultimately its price will be much higher.

However, we will not rely on reading tea leaves. In the following sections, I will describe how to check what stage of the bull market we are at.

OK, so on May 15, 2020, 1 BTC was around $8,570. If we are to repeat the increase from 2017, the price from Halving should increase by 37 times. So $8,570 * 37 = $317,090.

Of course, I am not taking it for granted by any means. I just want you to understand that there are chances even for such increases.

It might seem that it is even quite simple to achieve when unprecedented amounts of money are printed as if plucked out of the air all over the world, which in turn must lead to inflation. Meanwhile, in times of high inflation, people have to resort to non-depreciating assets to protect their capital. Bitcoin is such an asset.

Where to watch the Bitcoin chart?

The best and clearest charts can be found on the website: https://www.tradingview.com/chart. After launching the above page, click on the currency pair in the upper left corner:

Then enter „BTCUSD” in the search field and select the first item from the top.

How to distinguish a correction from the end of a bull market?

Every time there is a correction, you will see a surge of panic-strikers who will herald the end of Bitcoin.

This is because they do not have basic knowledge about this market, and their investments are based on… Well, it’s hard to say what. It looks like most people invest in the same way as betting on a red/black box on a casino roulette.

They don’t rely on any indicators and only buy because the price is rising. Typically, this purchase is made at the local top, followed by a 20-38% correction, and they sell at the bottom, telling the world that THIS IS THE END!

In turn, educated investors now buy more cryptocurrencies in accordance with the principle: ‘Be greedy when others are afraid, fear when others are greedy.’

Generally, novice investors prefer to invest when everything is growing and enjoy the profits for 2 days, and then cry for a whole month that they are at a loss because there is a correction. However, it is wiser to buy when everything is falling and see losses for two days (because we never aim for a perfect low), and then enjoy the profits for a month.

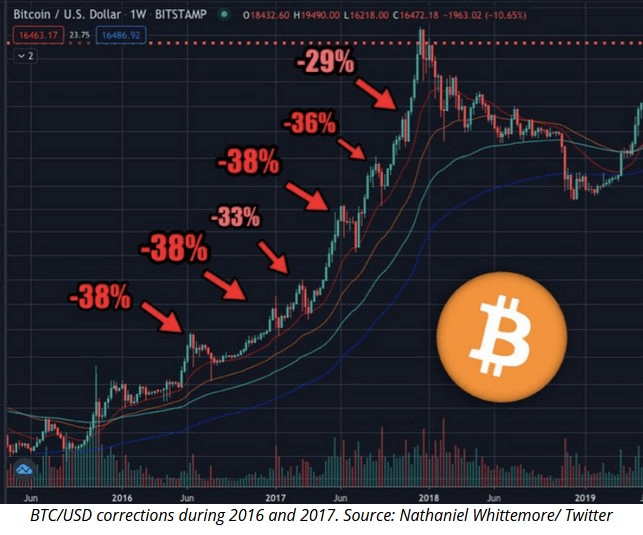

Before we go any further, it is worth taking a look at the chart showing the corrections during the bull market in 2017.

Of course, every time there was such a 38% correction, the end of Bitcoin was foretold. Experienced investors, on the other hand, used these moments as investment opportunities.

So how to distinguish whether this is the end of the bull market or another investment opportunity?

I will try to provide you with as many free charts as possible. Unfortunately, not all of them are available for free. Some of them can be found at: https://studio.glassnode.com in a subscription of $29 a month.

If you have large amounts of money to invest, it may be worth considering a subscription. On the other hand, if you intend to invest lower amounts, then of course such a subscription is pointless. Anyway, you can easily cope with using only free tools.

So let’s move on to one of the most important sections.

On chain indicators

The on chain data is publicly available and can be read from the blockchain. You don’t need to go into this topic. In short, the point is that the market behaves in a specific way at each stage of the bull market. Thanks to the on chain data, we are able to check if it’s time to sell our cryptocurrencies.

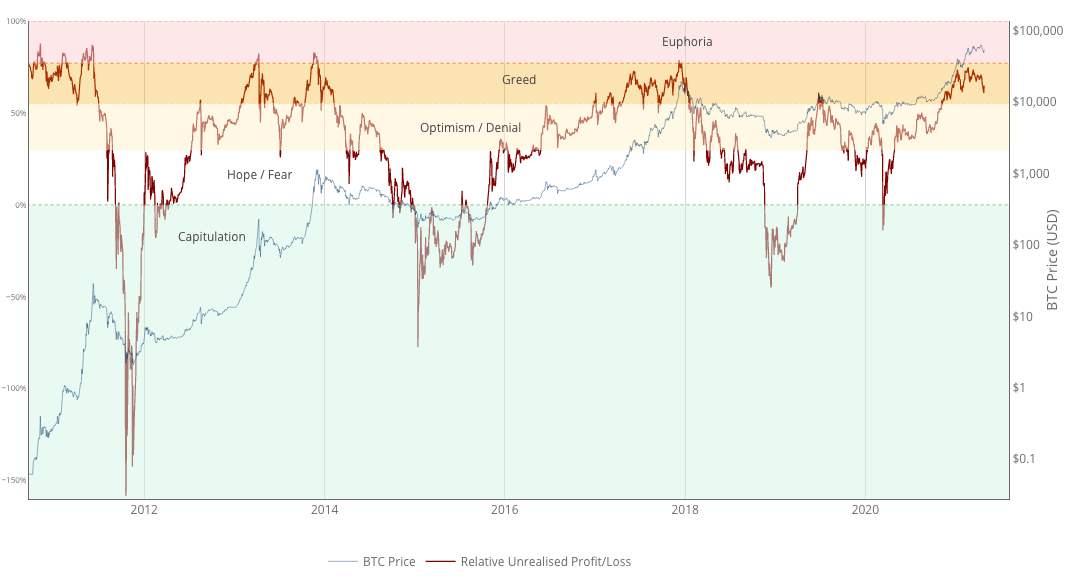

NUPL

You will find this indicator on the free website: https://www.lookintobitcoin.com/charts/relative-unrealized-profit–loss.

The NUPL (red line) shows whether the market as a whole is currently in profit or loss. The black line is simply the price of

1 Bitcoin.

Values below 0% (Capitulation) mean that if all current Bitcoin holders sold it at the current price, they would be losing money. This means that most people in the market have bought Bitcoin at a higher price and are now losing out.

On the price chart, this means lows and a good time to buy.

Let’s take into account, however, that the price is only going green during the bear market. If someone wants to enter during the boom in 2021, they will have to buy at the higher tiers. In the following chapters, I will describe when to do this.

Note that historically, when the red line exceeded the value of 80%, and thus even slightly entered the pink field meaning ‘Euphoria,’ it meant the end of the bull market (in 2013 and 2017).

It is said that in 2013 there was the so-called ‘double top’ or ‘fake top.” This means that all indicators showed the end of the bull market, and in reality there was only a very deep correction of 67%. In the same year, further increases began, and only when the NUPL hit the level of euphoria for the second time, a full-fledged bear market began and continued until the next Halving.

Regardless of whether the entry into the level of euphoria will mean the end of the bull market or a deeper correction – it is worth evacuating from the market at this point in order not to suffer large losses.

So you already know the first indicator. In short: if you see that we have entered the pink zone, it is worth taking profits because it is very likely that we will end the bull market.

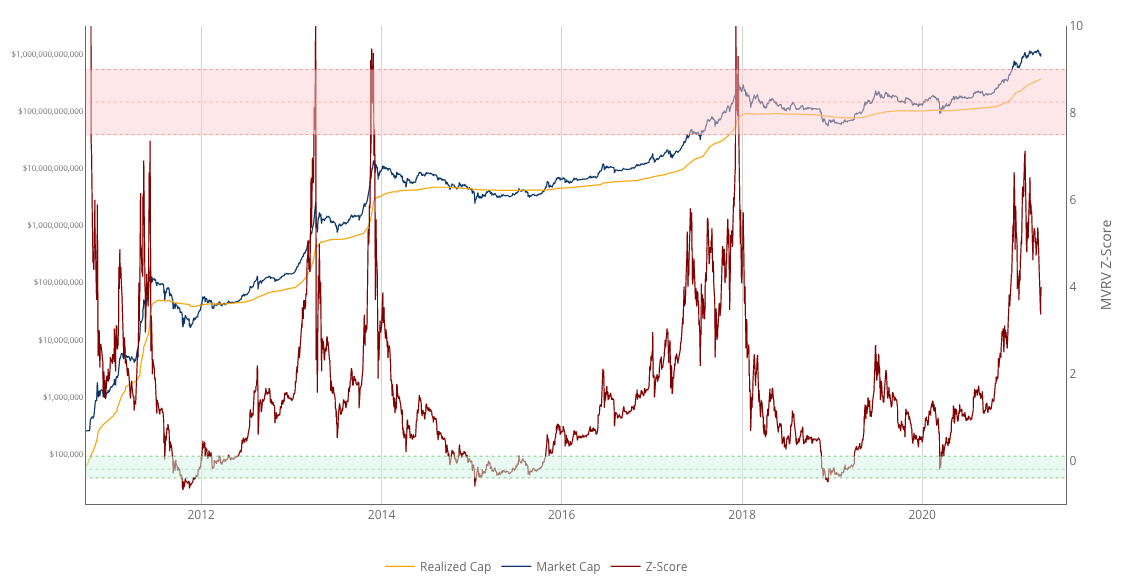

MVRV Z-Score

You can find this indicator at: https://www.lookintobitcoin.com/charts/mvrv-zscore

First, let me describe some points:

- Market Cap – this is the price of 1 BTC multiplied by the amount of BTC in circulation.

- Realized Cap – this is the price of 1 BTC at the time of the last move, multiplied by the amount of BTC in circulation.

- Last move – suppose you sent 1 BTC to your friend when it was worth $10,000. Your friend did not send this BTC anywhere else and it is still in the same wallet. The price at the time of the last shift in this case will be $10,000 because the last time Bitcoin landed in this wallet, it was just $10,000.

This chart shows the difference between the current Market Cap and Realized Cap.

The higher the value, the more Bitcoins are transferred between wallets at that point, which means more and more people are buying and selling their Bitcoins instead of holding them long term.

If you think about it, it’s easy to conclude that long-term investors are keeping Bitcoin in check. They have already seen declines of 40% and some as much as 90%. What if people familiar with the market sell their Bitcoins to beginners who have no experience and do not know how volatile the market is?

Of course, the big sell-off is starting as new investors are afraid of downs by up to 5%. More and more new investors start selling out of fear. Some of them will sell after a 5% drop, another by 10%, and so the avalanche begins.

Only long-term and informed investors could stop the declines without panicking and still holding Bitcoin. Except that they already sold it at the top with this new…

This way a bear market starts and the red line on the MVRV Z-Score is moving towards the green zone. When we get to it, we can talk about an opportunity to buy. Coming to this line means that most new investors have already got rid of their Bitcoins. There are practically only old traders left in the market, who do not even think to sell their Bitcoins, and investors who sold at the top and bought back from the inexperienced ones at a lower price.

On the other hand, if you pay attention to the moments when the red line was above the pink zone – then we are dealing with the peak of the bull market. These are the moments when most of the BTC in the market is owned by new people and it is worth evacuating at this point because a bear market is likely to start at any moment.

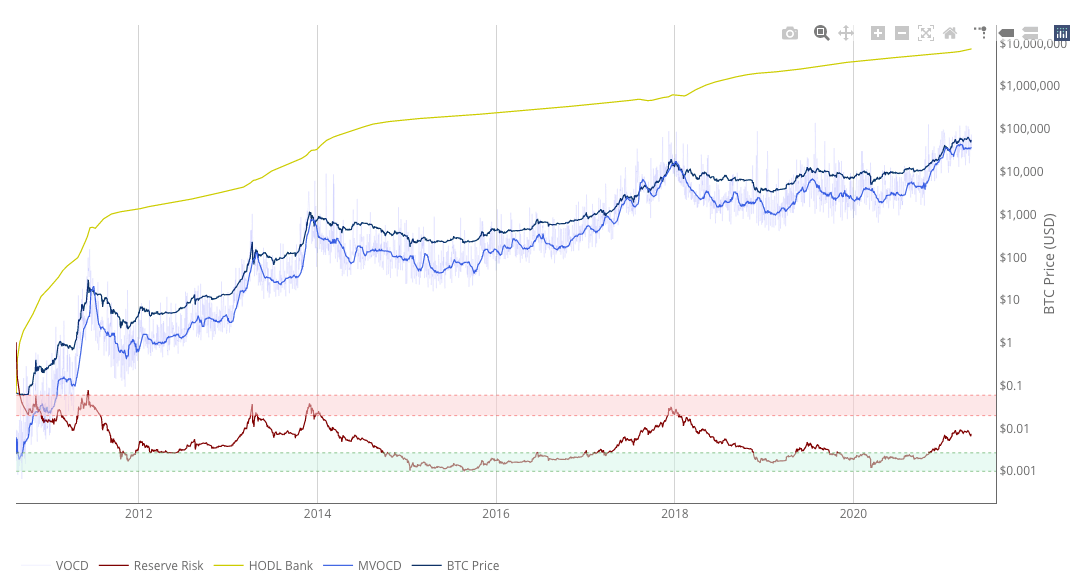

Reserve Risk

You can find the indicator here: https://www.lookintobitcoin.com/charts/reserve-risk

Here we mainly pay attention to the small chart at the bottom.

This indicator shows the risk-reward ratio based on confidence in Bitcoin by long-term investors. This is very similar to the MVRV Z-Score. The longer investors keep their cryptocurrencies in the wallet without moving them, the closer the red line is to the low levels (in the green zone).

In short, the green tiers are ideal levels to buy during a bear market. On the other hand, pink levels are ideal levels for selling during a bull market.

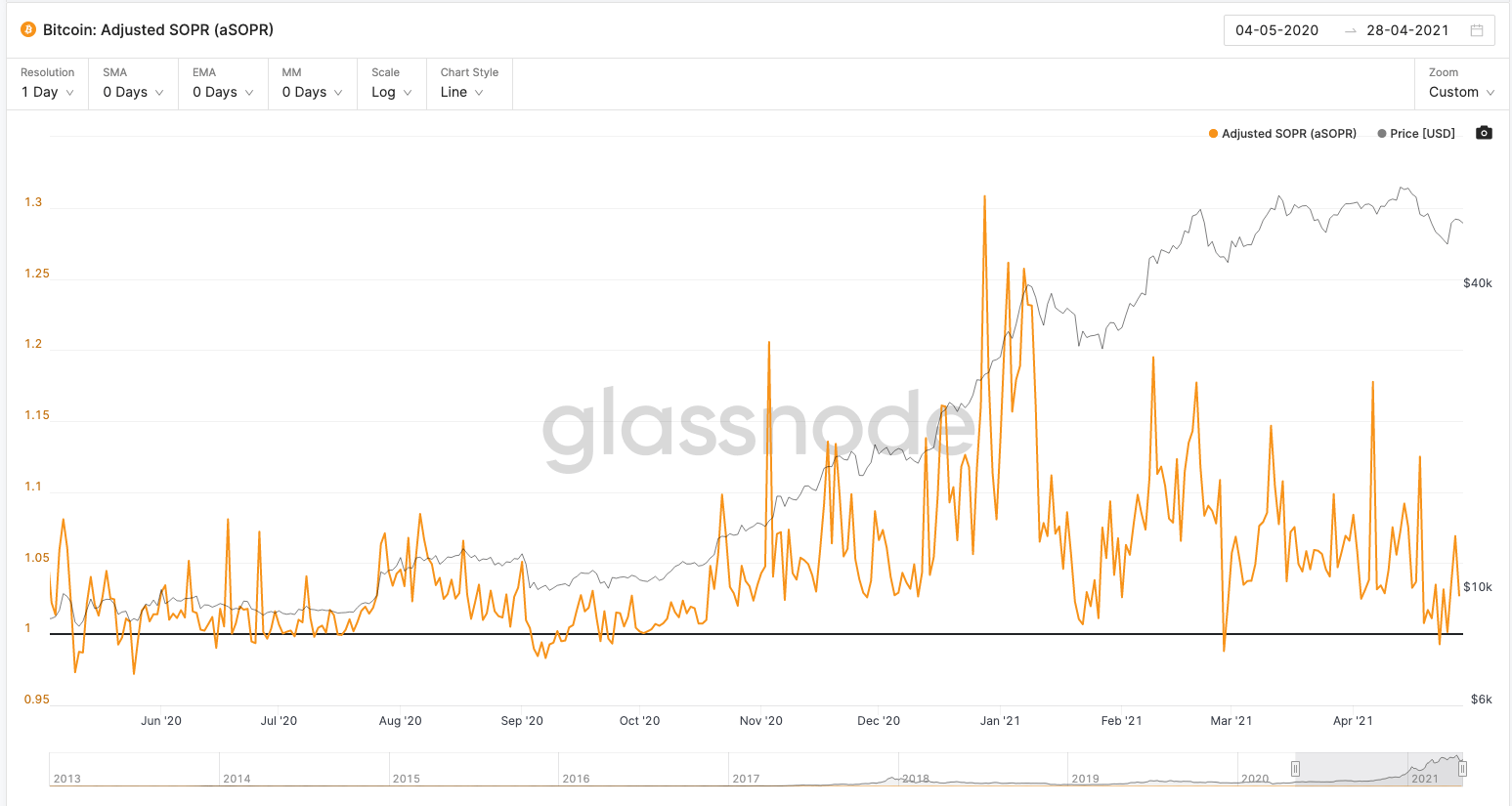

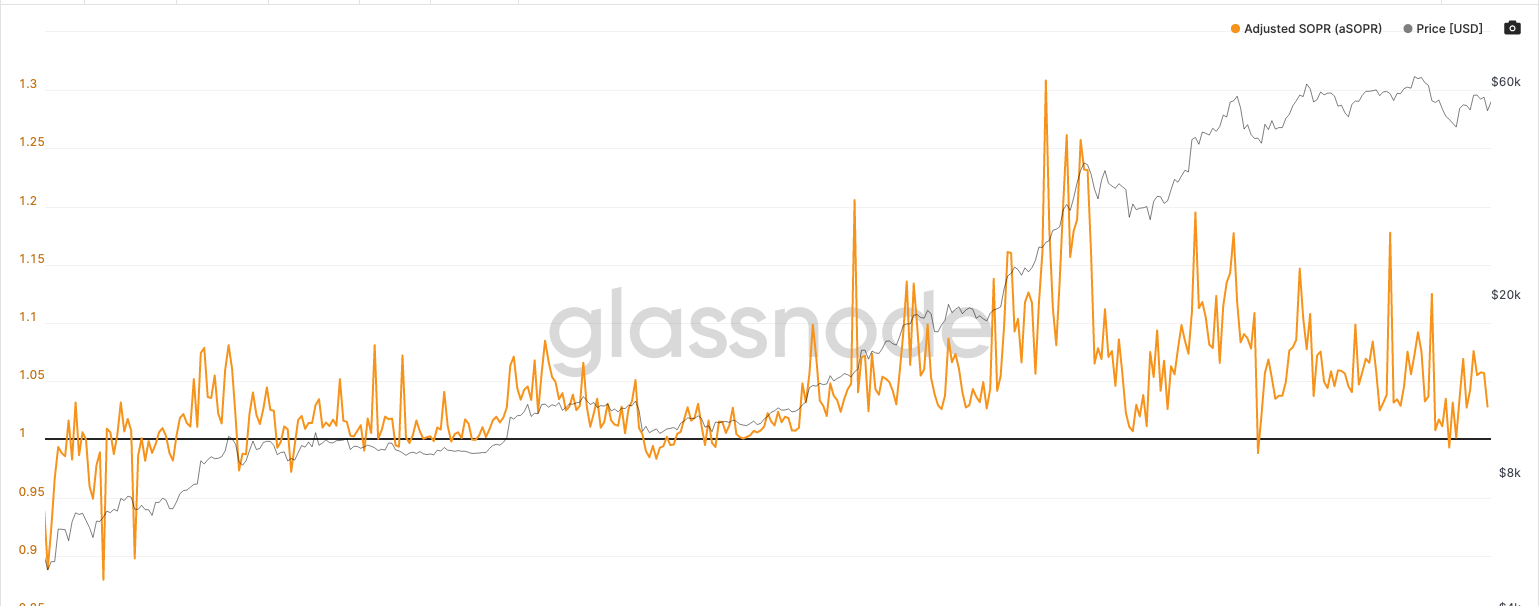

aSOPR

This is an indicator that is unfortunately only available on a paid subscription (you can view it for free, but only historical data): https://studio.glassnode.com/metrics?a=BTC&m=indicators.SoprAdjusted&resolution=24h

As already mentioned, if you are investing with small capital, do not buy access (at least until you multiply this amount). On the other hand, if you intend to invest more money, I think it is worth investing in this tool, because $29 per month is not an excessive amount in relation to the returns this market gives during a bull market. There are also all the other pointers I’ve been describing on Glassnode.

The most important in this indicator is the horizontal black line marking level 1.

If the orange line is above level 1 (the black horizontal line), then most of the market is selling Bitcoin at a profit at this point.

Conversely, if the line is below level 1, most of the market sells Bitcoin at a loss.

During a bear market, the orange line is below level 1 most of the time.

During a bull market, the orange line is above level 1 most of the time.

aSOPR is useful for identifying two things:

Trend reversal

If we have a bearish market, as I mentioned, the orange line is under level 1 most of the time and most people sell at a loss. Then the orange line bounces off the bottom of the black horizontal line.

This is because the moment aSOPR goes from the bottom to level 1, most people have zero or minimal profit with their investment and sell their cryptocurrencies immediately. They are aware that there is a bear market and are glad that they managed to get at least what they invested. Thus, the price of Bitcoin is going down and the orange line is going back down.

However, when aSOPR is reaching level 1 from the bottom and Bitcoin’s price is not starting to fall, it may be the moment when the bull market begins. Since the price is not falling, then most of the market no longer accepts it to break even. Everyone feels that the price will continue to rise and they prefer not to sell, but to wait for more profit. Thus, the orange line passes over point 1 and the bull market begins.

During the bull market, the orange line is above the horizontal black line most of the time, which means that most people are selling Bitcoin at a profit. If the orange line comes to level 1 from the top (meaning most of the market goes to zero), we bounce back up immediately.

This is because most of the market believes there is a bullish market and they have no intention of selling Bitcoin at zero. After all, since there is a bull market, they prefer to wait for the price to rise in order to sell at a profit.

However, when aSOPR reaches level 1 from the top, and the Bitcoin price does not start to rise, we may be dealing with a bearish phase. This means that most of the market accepts that they are at zero or slightly losing. Investors are so afraid of further declines and the bubble bursting that they are selling anyway. Thus, the orange line returns to the lower regions and the bearish phase begins.

Local lows

During a bull market, aSOPR resets many times, so it touches point 1 to bounce up again.

If the remaining indicators discussed (NUPL / MZVR-Z Score / Reserve Risk) do not point to the end of the bull market, and aSOPR is almost touching or has touched level 1 (black horizontal line), this is the perfect time to buy.

This means that, on average, the market sold out at a profit and now people would have to accept the sale at a loss. Of course, they do not do it, because other indicators show that the bull market is still going on. Consequently, there are no sellers, so the price stops falling.

If you buy your BTC at this point – bravo! Most likely, the market will start to rebound at any moment (within a few days) and grow aggressively, and it will generate huge profits for you.

Do you already know when it is just a correction and when the bull market ends?

Knowing that in the past corrections on BTC were even 39% and taking into account the indicators discussed here – from now on you will be able to easily distinguish whether it is a correction or the end of a bull market.

From now on, you can use adjustments as investment opportunities.

Most of the people in this market behave in a very funny way. At the moment when everything grows, they are waiting for

a correction. On the other hand, when a correction occurs, instead of taking advantage of the opportunity they have been waiting for, they prefer to announce the burst of the bubble once again ????

I hope that these indicators will allow you to become a conscious investor.

Cryptocurrencies are not a casino as most ignorant people believe. The indicators that operate on this market are more accurate than on any other market.

When to buy Bitcoin?

Of course, it’s best to buy Bitcoin when we have a bear market, and the indicators I mentioned show lows (they are in the green zones).

Nevertheless, we are currently in a bull market and you will not be able to buy anything in the green zones until the next bear market. In turn, the next boom will not take place until 2025.

You would probably prefer to take advantage of this boom. There is still a good chance to earn 100% on Bitcoin alone (I’m writing this on April 29, 2021) and a lot more on altcoins.

There will be a separate section about altcoins. First, let’s focus on Bitcoin, because its behavior is the most important in the entire cryptocurrency market and it affects all altcoins.

The first and most important rule. Never buy on top!

Rush in this market does not pay off. Always wait for a correction before buying, and when it arrives, average your purchase!

We’ll talk about averaging in a moment.

At the same time, remember how volatile the market is. Correction, it is not a slight reduction of the price somewhere at the top by 5%. The correction is a decrease of 20-40%.

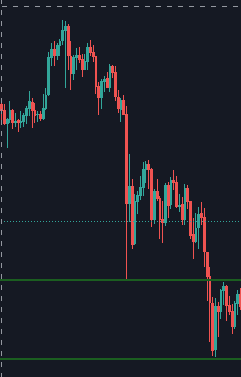

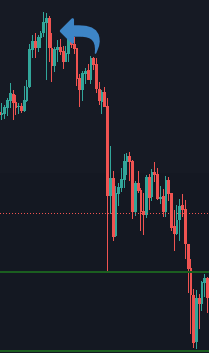

This is a correction:

And not this:

If you invest larger amounts and can afford a Glassnode subscription, the aSOPR indicator, which I have written about above, will help you determine the local low.

Purchase averaging

Let’s try not to invest all the capital we have at once. Suppose you decided to invest $1,000 in cryptocurrencies.

If, for example, BTC drops by 15%, then make a purchase for 50% of this amount, so $500.

Then wait a few days. Often then there is a price consolidation like here:

If the price goes up, that’s great. You are already in the market and your $500 is earning. Leave the remaining $500 for a better opportunity and put them in for Flexible Savings (this is the deposit I will write about later).

On the other hand, if the price drops by another 10-15%, this is the perfect time to buy for another 50% of your capital.

What do you gain from this approach?

Imagine 1 BTC costs $1,000 and you buy it for the entire amount you have for investment. The next day, the price of 1 BTC drops to $700.

Unfortunately, you have a loss of $300. Now, to break even, the price has to go back to $1,000. Only when it is $1,001 will you earn your first dollar.

Now with averaging

The price of 1 BTC is $1,000, but you only buy it for half your capital, which is $500.

BTC is divisible to 8 decimal places. You can only buy 0.00000001 BTC.

The price of 1 BTC drops to $700. However, at this point, you are using your second $500 and buying BTC at the lower price.

So the average price you bought BTC for is: ($1,000 + $700)/2 = $850.

Without averaging the price, it would have to rise back to $1,000 to make up for the loss.

Thanks to averaging, the break-even point is when the price rises from $700 to $850. On the other hand, when it reaches $1,000, you already have $150 in profit.

- If the price starts to rise. Cool! You already have $500 invested and you can enjoy the profits.

- If the price starts to drop, you keep investing another $500 averaging the price, and only a slight bounce back up makes you profitable.

Cryptocurrency Taxes

In most countries around the world, cryptocurrency tax is charged on a similar basis. Nevertheless, be sure to check what it is like in your country.

Namely, in most countries, the tax obligation occurs only at the time of selling cryptocurrencies for FIAT currencies. These are the currencies we use every day, such as EUR, USD, GBP, etc.

Suppose you bought cryptocurrencies for $1,000. Then you sold them for the exact same amount.

Do you have to pay tax?

No. We pay tax only on the profit we have earned. In this case, you bought cryptocurrencies for $1,000 and sold them for $1,000, so you didn’t make any profit.

Now suppose you bought cryptocurrencies for $1,000 and sold them for $5,000.

How much will you pay tax on?

Tax is only paid on profit. Since you sold cryptocurrencies for $5,000, but first bought them for $1,000, you will pay tax on the difference, so $5,000 – $1,000 = $4,000.

You will pay tax on the amount of $4,000.

Stablecoins

These are cryptocurrencies that always have a value of 1 to 1 to the dollar.

The most popular stablecoins are:

- USDT

- USDC

- BUSD – stablecoin of the Binance exchange

All of the above-mentioned stablecoins are characterized by exactly the same thing:

- 1 USDT = $1

- 1 USDC = $1

- 1 BUSD = $1

This means that if you have, for example, 100 BUSD, you can exchange them for exactly real $100 at any time.

Why use Stablecoins?

For three reasons:

- Some cryptocurrencies on the stock exchange can only be bought for stablecoins.

- Stablecoins are also a cryptocurrency, which makes it easy for us to transfer them between different cryptocurrency exchanges. We can also send them to an external wallet (more on that later).

- Some countries do not treat stablecoins as an asset, so if you convert, for example, BTC to USDT, you do not have to pay tax on profit. Only when you convert USDT to USD will you pay the tax. You must check how it works in your country.

Where to buy Bitcoin?

If you are a US citizen, the largest and safest exchange for you is: https://www.coinbase.com.

Additionally, you will get $10 if you create an account from the link above and make a purchase of cryptocurrencies for $100.

In turn, if you are not a US citizen, it is worth using the largest stock exchange in the world, i.e.: https://www.binance.com.

Altcoins

Bitcoin is the world’s first created cryptocurrency. Its success has made many people around the world interested in blockchain technology and the benefits that stand behind it.

From now on, businesses do not have to rely on one person or a group of several people to control them. They also don’t have to be vulnerable to government action.

For example, if a decentralized Facebook were created, it would be up to the community to decide whether or not to remove the content. Not to a specific group of people like at present. The community would be people with voting cryptocurrency.

You can say that altcoins are the equivalent of normal companies, but in a decentralized world.

In my opinion, the best place to check and search for altcoins for investment is: https://www.coingecko.com. On this site we will see a list of most altcoins that are available for purchase on various exchanges. They are sorted by capitalization.

Capitalization is the value of one coin multiplied by the total amount available in the market.

Behavior of altcoins in relation to BTC

Throughout this article, for your convenience, I wrote about investing in BTC, excluding altcoins. I did it for the sake of simplicity, so as not to mess too much. There is also a second reason. It is the correlation of BTC in relation to altcoins.

Each altcoin is a separate entity. One goes up more, the other goes up less, the price for the third goes down. Despite this, the price of all altcoins is closely correlated with the price of Bitcoin.

More precisely, the following dependencies can be noticed:

If the price of Bitcoin is rising rapidly then: the price of altcoins is also rising, but slower than the price of Bitcoin.

If the price of Bitcoin is falling rapidly: the price of altcoins is also falling, and much more in percentage terms than the price of BTC (if BTC drops by 20%, altcoins may drop by as much as 40-50%).

If the Bitcoin price rises at a slow pace or slightly fluctuates upwards or downwards, then: altcoins are growing very quickly (when BTC rises by 1%, some altcoins may rise by as much as 20-30%).

Considering the above observations, it is easy to conclude that even if we want to buy some altcoins, we should wait for the BTC correction in the first place.

When such a correction occurs and the ‘on chain’ data shows that this is not the end of the bull market, it is a very good idea to invest in altcoins. This is because, since BTC has dropped by 20%, a lot of altcoins have dropped by 30-50% at the same time and this is a good time to buy them.

The moment you buy altcoins after such a drop and the BTC price starts to rise again, altcoins will also shoot, recovering all losses within a few days. In fact, when you invest in altcoins at the right time, you are able to double your capital in a very short time.

When to invest in altcoins?

Generally speaking, this market is characterized by the fact that in the initial phase of the bull run, Bitcoin grows much more than altcoins. At some point, the BTC price breaks the top of the previous bull market. Thus, the media are starting to trumpet that Bitcoin costs so much, and this is why more and more investors are pouring into the cryptocurrency market.

Nevertheless, at some point, the price of Bitcoin seems very high and people decide to buy much cheaper altcoins hoping for bigger increases. Then the so-called ‘altcoin season’ starts – a period when altcoins are growing much more than Bitcoin.

You can check it here, for example: https://www.blockchaincenter.net/altcoin-season-index.

Is it worth investing in altcoins?

Altcoins are a much more risky investment than Bitcoin but yield disproportionately higher returns.

If you would like to invest a lot of capital, in my opinion, it is better to focus on Bitcoin because it is the most stable cryptocurrency and its price is constantly increasing in the long term. Even if you had invested at the very peak of the boom in 2017, today (May 2, 2021) you would have earned 300% on this investment.

In the case of altcoins, the situation is a bit different because sometimes in the next bull market they are not able to make up for the price from the previous bull market.

After all, even if you invested a lot of capital, I would spend 10-20% of the total on investing in leading altcoins.

On the other hand, if your capital is small, I would really only invest these funds in altcoins, bypassing Bitcoin, to get a much larger profit.

Which doesn’t mean you shouldn’t check Bitcoin’s price. Even if you are not going to buy it, you need to watch its price and enter altcoins only when there is a correction on BTC.

Altcoins that I recommend to start with

The altcoins that I will mention have solid foundations and are quite safe to invest. It is worth buying a bit of each of them and saving a small part of the capital to invest in other projects that will attract your attention.

You can read about the problems that altcoins solve here: https://www.coingecko.com.

Altcoins worth attention are (according to my subjective opinion – this is not investment advice):

Unfortunately, not all of them can be found on the Coinbase exchange, so in the following parts of this compendium I will show you how to create an account on Binance even if you are a US citizen.

- Ethereum (ETH)

- Binance Coin (BNB)

- Polkadot (DOT)

- Polygon (MATIC)

- Chainlink (LINK)

- Solana (SOL)

- Cosmos (ATOM)

- Terra (LUNA)

- 1Inch (1INCH)

These are very safe altcoins to start with. However, it is worth spending some time reading about others that you can find at: https://www.coingecko.com and invest some capital in something that you think has potential.

If you use the Binance exchange, it is worth buying the BNB cryptocurrency in the first place. It is the official cryptocurrency of the Binance exchange. Having it on your account, you automatically pay a lower commission for making transactions. Therefore, it is always worth having even small amounts of BNB in your wallet. Moreover, the price of BNB is rising at an astonishing rate.

The truth is that during a bull market all altcoins go up but sometimes those gains are unimaginable – even as high as 300% in a matter of days.

Profit-taking strategy

As for Bitcoin itself, the best strategy for me is to buy it and hold it until chain indicators begin to suggest that this may be the end of the boom. In my opinion, it makes no sense to sell BTC to wait for a correction and buy lower again.

When you sell your BTC and its price drops by 20% as a result of a correction, you’ll be happy with your decision. However, if you sell it and the price goes up by 20%, you will actually be losing the 20% that you could have gained but you didn’t because you made the sale before. Rather, I would adopt a sales strategy only at the end of the boom, and at the time of large corrections I would buy more BTC.

In the case of altcoins, we have a little more to win because at the time of correction, their price often drops by as much as 30-50%. Therefore, I personally adopt the strategy of gradual profit taking from altcoins.

I start gradual profit-taking if:

Bitcoin price exceeds its ATH (All Time High)

After fulfilling this condition, I try to sell 10-15% of every altcoin I own every day.

The price of a given altcoin SIGNIFICANTLY exceeds its ATH

If an altcoin has shot incredibly high above its ATH, it makes sense to start slowly taking profits from that particular altcoin as the correction can happen much faster than on BTC. After all, other investors who are satisfied with the big gains also want to take profits and the price may fall.

What to do with profit-taking funds?

One of the basic beginners’ mistakes is gradually selling their altcoins and investing those funds in other altcoins immediately, rather than waiting for a deeper correction on Bitcoin.

This doesn’t make much sense because how can you be sure the altcoin you have just transferred to will start growing? You may find that the one you have sold grows by another 50%, and the one you have bought starts falling or stagnates.

Hence, DO NOT BUY any cryptocurrencies until the next deeper correction on BTC.

When there is a deeper correction on BTC and all altcoins, and you know that this is not the end of the bull market (because the ‘on chain’ data does not show it), start buying again on lows, using the price averaging strategy, which I have written about in the ‘Purchase Averaging’ section.

What if there is a correction and you haven’t sold all your altcoins?

In fact, this will almost always happen. If this happens – DO NOT PANIC!

Just don’t do anything. I know it’s hard to see drops of 20-30% but if you bought your altcoins at the right moment, you will probably be on a significant profit even after these drops.

The worst thing you can do is sell everything in a panic. At this point, you should really try to buy, not do the complete reverse and sell everything.

During the bull market all altcoins grow. All you have to do is wait for the BTC correction to end, and altcoins that you didn’t realize on profits will rise to their previous levels very quickly.

‘Stop loss’ and ‘Return to normal’

First of all, we need to distinguish between ‘trading’ and ‘investing.’

Trading means selling and buying back your cryptocurrencies several times a week.

Investing, on the other hand, is more about buying at the bottom, buying more on the corrections and selling everything before the end of the bull market. In the case of altcoins, we sell them several times during the bull market. However, it is not that we observe the chart every day and analyze it in depth as day traders do.

In the end, investors and traders will make comparable profits. But traders have to spend much more time. In fact, they have to watch the charts all day long.

Stop loss

Many people will say that ‘stop loss’ is essential and it is indeed essential, but for traders. Such people want to generate profits every day by ‘guessing’ which way the chart will go. Nevertheless, there is no way to be 100% right. Good traders are right 75% of the time. A stop loss is a way to limit losses in the remaining 25% of the cases where they are not.

People who are investors should not use stop losses. As an investor, you are setting yourself up for a profit that you will take in a few months for BTC (or a few weeks for altcoins) when the on chain indicators show the end of the bull market.

If the price of 1 BTC is now $55,000, and you only sell it when it reaches $200,000 in a few months, it doesn’t matter to you what happens in the meantime.

If you had a stop loss, you would often be kicked out of the market by activating it and would have to buy your cryptocurrencies again. Additionally, VERY often at a higher price. In short, this is how you lose.

Return to normal

Our security as investors is the knowledge about the occurrence of the so-called ‘return to normal.’ It can be said that this is a stop loss for investors.

Let’s assume that we have overslept and haven’t checked the ‘on chain’ data, and it turns out that everything points to the end of the bull market. Or we wanted to choose the measures we urgently needed, and suddenly there was a significant correction. In that case also do not panic sell!

Every time after the correction, or even when the bull market is over, there is a ‘return to normal.’ This is a momentary rebound of the price upwards. Then we can calmly analyze everything and, if we consider it appropriate, sell our cryptocurrencies but at much higher prices than if someone does it in panic when everything is falling.

Analyze the below charts:

As you can see, history shows that if you are late, the market always gives you a second chance to take profits. You don’t have to panic sell everything at a much lower price.

Where to store cryptocurrencies?

The truth is that the exchange is not designed to store cryptocurrencies. The cryptocurrency exchange is only a platform for buying and selling them. After making the transaction, you should transfer the funds to your external wallet.

But should you?

Most cryptocurrency ‘gurus’ mention that cryptocurrencies should never be kept on the cryptocurrency market. However, they forget to add that in the case of small amounts withdrawing cryptocurrencies from the exchange does not make any sense.

This is because during a bull market the commissions for sending cryptocurrencies are so high that simply transferring them to your wallet and back to the exchange would consume your entire return on the investment.

For example, on May 3, 2021, the cost of transferring BTC to an external wallet was $20.57 (regardless of the amount you wanted to transfer). So if you had wanted to send BTC first to your wallet and then back to the cryptocurrency exchange to sell it, you would have had to spend $20.57 * 2 = $41.14. In the meantime, the cost may have increased.

Most altcoins use the ETH network where the cost of transfer is $8.92 (as of May 3, 2021). So in order to transfer a given altcoin to your wallet and back you need to pay $8.92 * 2 = $17.84. Assuming you had 5 different altcoins purchased, the transfer cost would be 5 * $17.84 = $89.20.

So you have to pay $89.20 to transfer your 5 altcoins to an external wallet and an additional $41.14 to transfer your Bitcoins.

If you invest small amounts, it is completely unprofitable. Transferring cryptocurrencies back and forth takes too much of the profit.

It is different if you invest much higher amounts. Then the cost of transferring up to $100 round trip seems ridiculous because you will have such fluctuations in your wallet every few minutes and sometimes even more.

A 1% increase or decrease in 5 minutes in the cryptocurrency market is standard. For example, if you have an investment of $100,000, a fluctuation of 1% means an increase/decrease of $1,000. If you invest after the correction, the profits will be so large that $100 per transfer is not going to make a difference.

How safe is it to keep funds on the cryptocurrency exchange?

There have been many cases when cryptocurrency exchanges shut down or were hacked. That is why it is best to use only reputable exchanges such as Coinbase and Binance.

These exchanges keep most of their funds in external wallets, so even if attacked, the hacker is able to steal only a ‘penny’ amount of cryptocurrencies (up to 2.5% of everything that is deposited on the exchange). The hacker cannot reach the rest of the cryptocurrencies because they are located on external devices

(I will describe how such devices work in a moment).

Moreover, even if the theft occurs, the Binance and Coinbase exchanges are able to cover such losses to keep customers’ trust and confidence.

Use of external devices

We already know that using an external wallet is not profitable for small amounts because the infrastructure of Binance and Coinbase is well organized well enough so that your funds are safe. Also, the cost is so high that it would eat up all your profits.

Nevertheless, no sane person would hold large sums in an exchange that depends only on one man. It is generally never good if we are dependent on one person or company. Regardless of whether we are talking about running a business or cryptocurrencies.

Therefore, if you are investing larger amounts, it is worth ordering the Ledger Nano X device.

It is one of the most popular devices of this type in the world.

To understand what the use of such a device is, we first need to discuss a very important point.

All cryptocurrencies, regardless of whether we keep them on the cryptocurrency exchange or on our device, are actually placed on a public blockchain. That is, there is no way that your cryptocurrencies will be lost because you have lost your device. The Ledger Nano X simply stores your wallet address and the key (i.e., password) for that wallet. However, cryptocurrencies are placed on the blockchain network, not on the device itself.

To understand this even better, let me discuss it using an example.

When you start configuring your Ledger Nano X device, a wallet address and a key (password) for this wallet will be generated.

After that you can leave your device at home and travel to the other side of the world, and then send the cryptocurrencies to the address that was generated. It doesn’t matter that your device lies in the closet a few thousand kilometers away and is not connected to electricity or the internet.

You don’t send cryptocurrencies to this device but to a specific address (wallet) in the blockchain network. In turn, only you have the password to this address and it is saved on the device.

Only when you want to send your cryptocurrencies back to the cryptocurrency exchange, will you need access to this device.

To send cryptocurrencies from your wallet to another, you need to use the key saved on your device.

On a daily basis, when using Ledger Nano X, you will have access to your keys by entering the PIN you set for the first time. It is very quick and easy to use.

But what if the device is stolen?

When setting up the device for the first time, a seed phrase is generated. It is 24 random words that you must write down with a pen on the 3 sheets included in the set. Each of the word sheets should be placed in a different location (so that no one but you knows that they are there and that they cannot be found).

If someone steals your device, you can still feel 100% safe because that person does not know your PIN. Ledger Nano X uses a processor that is also used by banking systems. As it turns out, even services such as the FBI are not able to crack the PIN for this device.

Some time ago there was a situation in Germany where the police commandeered a device with cryptocurrency keys worth several dozen million euros. Nevertheless, the police failed to recover them because they were unable to break into the device, and the criminal refused to provide the PIN.

What if someone does not have access to your device (because they do not know your PIN), and you also do not have access to it because it has been stolen from you?

This is where 24 random seed words come in handy, which are generated during the first configuration. All you have to do is buy a new device and enter the word ‘seed’ on it, and the new device will automatically have the keys to your cryptocurrencies.

At this point, all you have to do is send your cryptocurrencies from your device to the cryptocurrency exchange. Then you will configure Ledger from scratch to create new seed words, wallet addresses and keys. Then you send cryptocurrencies from the exchange to the newly generated addresses.

At this point, even if a criminal gains access to your stolen device (which is almost impossible), there won’t be any cryptocurrencies there.

As you can see, the use of such a wallet is so safe that even the police are not able to confiscate your funds. ????

This clearly shows that cryptocurrencies are the power and mainstay of our freedom.

Summary

If you have any questions, please write tem in the comment section below.

Good luck investing!

Part 2

The next part of this compendium is ready. You will find it here: https://learncryptocenter.com/en/knowhow-p2/.